Income Tax Return 2025 Calendar Calculator Using – they can utilize the new income tax calculator for FY 2023-24, which is user-friendly and cfan provide results in just a few simple steps. . The earned income tax credit errors in close to 25% of tax returns claiming it. Online tax filing software can help. The IRS also offers an “EITC Assistant” calculator. .

Income Tax Return 2025 Calendar Calculator Using

Source : www.energy.govConcept Tax Payment Data Analysis Paperwork Financial Research

Source : www.istockphoto.comClaim Your Missed 2021 COVID Sick and Family Leave Credits Today

Source : www.linkedin.comFederal implications of passthrough entity tax elections

Source : www.thetaxadviser.comEARNED INCOME TAX CREDIT AWARENESS DAY January 31, 2025

Source : nationaltoday.comFederal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.govTaxable Income: What It Is, What Counts, and How To Calculate

Source : www.investopedia.comCommercial Activity Tax (CAT) | Department of Taxation

Source : tax.ohio.govAverage Tax Refund This Year Is $1,395: Why You Should File Your

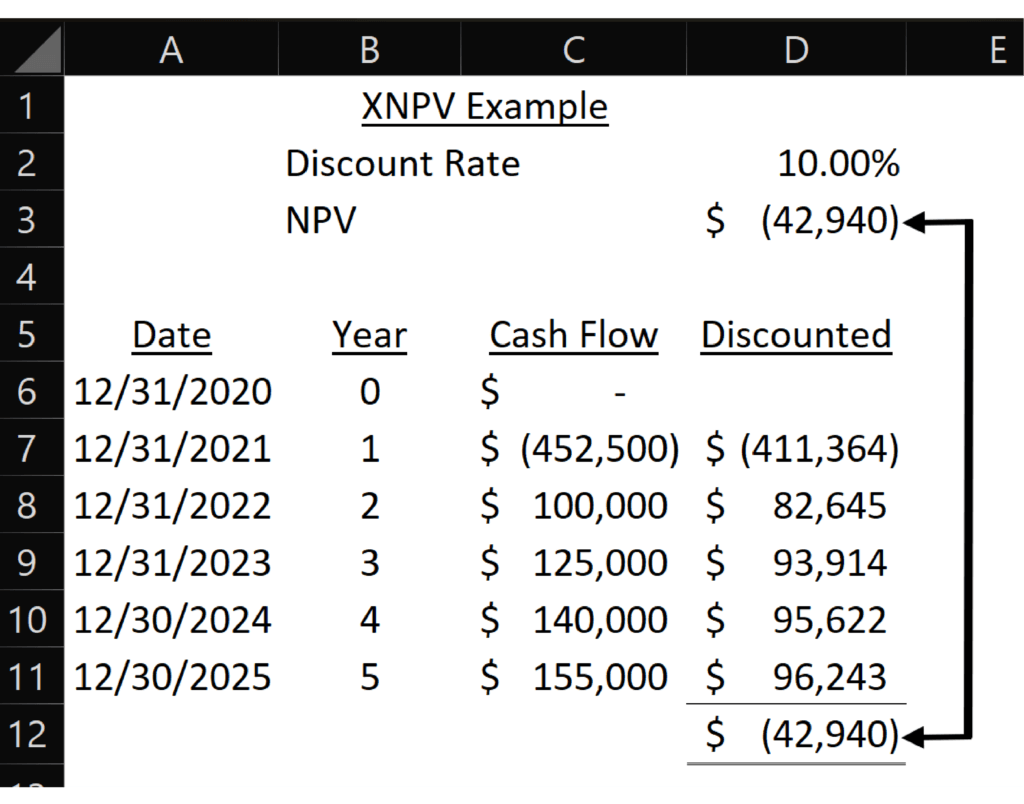

Source : www.cnet.comAssess Return with NPV, IRR, and Time to Break Even in Excel

Source : cfoperspective.comIncome Tax Return 2025 Calendar Calculator Using Federal Solar Tax Credits for Businesses | Department of Energy: The good news is, with the April 15 deadline to file your federal income tax returns quickly approaching, your tax return refund is around the corner, too. But when exactly can you expect to get . 20.5% On the portion of taxable income using the Consumer Price Index data. These increases tax effect on January 1 of the applicable year. The 2024 tax year, and the return due in 2025 .

]]>

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)