Income Tax 2025 Calendar Calculator Using – The Income Tax calculator is an easy-to-use tool which helps you figure out the income tax which you are required to pay for the financial year. To use this application for FY 2024-25, simply . 20.5% On the portion of taxable income using the Consumer Price Index data. These increases tax effect on January 1 of the applicable year. The 2024 tax year, and the return due in 2025 .

Income Tax 2025 Calendar Calculator Using

Source : nationaltoday.comFederal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.govTax 2025 text on wooded blocks with blurred nature background

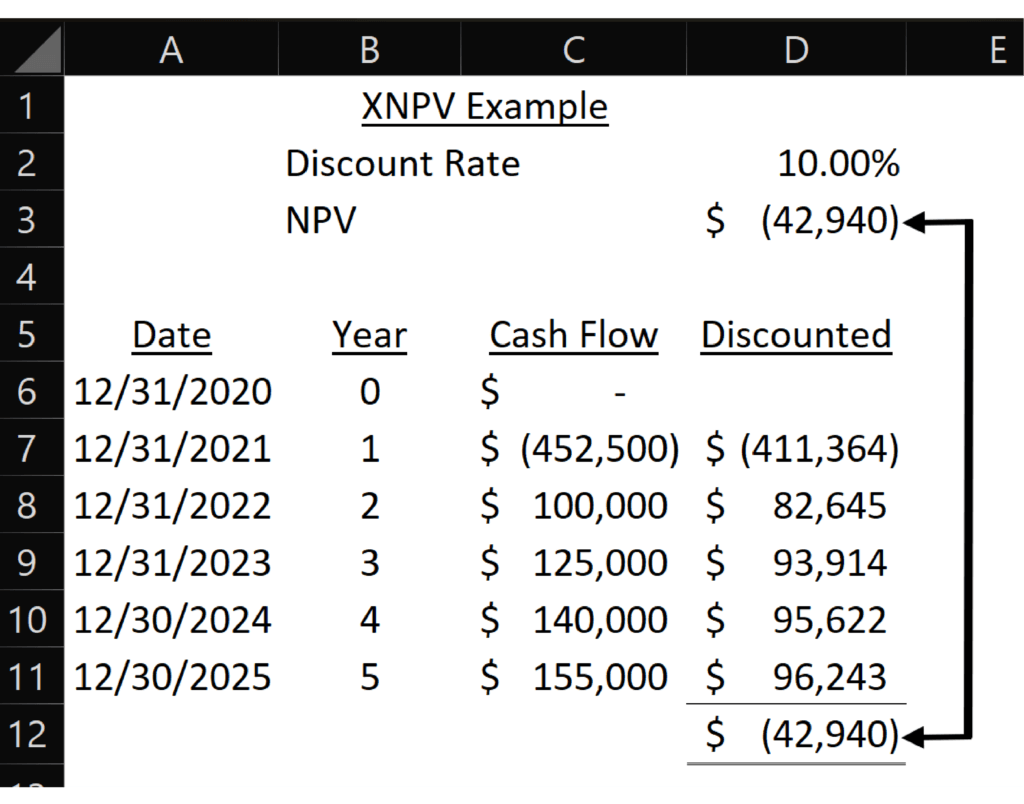

Source : www.alamy.comAssess Return with NPV, IRR, and Time to Break Even in Excel

Source : cfoperspective.comConcept Tax Payment Data Analysis Paperwork Financial Research

Source : www.istockphoto.comFederal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.govFederal implications of passthrough entity tax elections

Source : www.thetaxadviser.comTax Brackets in the US: Examples, Pros, and Cons

Source : www.investopedia.comCommercial Activity Tax (CAT) | Department of Taxation

Source : tax.ohio.govTaxable Income: What It Is, What Counts, and How To Calculate

Source : www.investopedia.comIncome Tax 2025 Calendar Calculator Using EARNED INCOME TAX CREDIT AWARENESS DAY January 31, 2025 : Below, you’ll learn what qualifies as payroll tax, how to calculate $7,000 in income, the employer can stop paying FUTA tax on them. Form 940 is the tax form that employers use to report their . An expanded child tax credit in 2024 and 2025 by allowing a higher maximum credit, greater refundability and more flexibility on the income a family can use to calculate the credit. .

]]>

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)